Greensolver Index, the unique benchmarking tool for wind farm is now available in the Netherlands – discover a few examples of the analysis available in the tool.

Greensolver Index, the unique benchmarking tool, has shown to be a great success in France and keeps increasing its value in the United Kingdom. With now more than 121 wind farms and 1.7GW of assets signed up, Greensolver Index is an innovative benchmark solution that enables like for like comparison and analysis of wind assets across more than 45 key performance indicators.

Indeed, by comparing your assets with others of the benchmark, you are provided with a real and unbiased overview of how your assets are really performing, and have data to challenge your O&M provider. Let’s make a concrete example out of it and discover the analysis you can do with Greensolver Index right below.

As of today Greensolver Index will be launched in the Netherlands so all wind farms in the Netherlands can gain from the benefits of this tool. Not yet a subscriber? Join us now, subscription are free until April 30th, 2017!

Greensolver Index report

This report has been extracted from Greensolverindex, in order to compare a portfolio performance with the benchmark, on a customer demand.

The report was initially created in 2015, 2016 results and findings are displayed in a light version, to provide you with some potential ways of improvements we can investigate further.

If you’d like to see how Greensolver Index can help you improve your asset profitability, don’t hesitate to contact us.

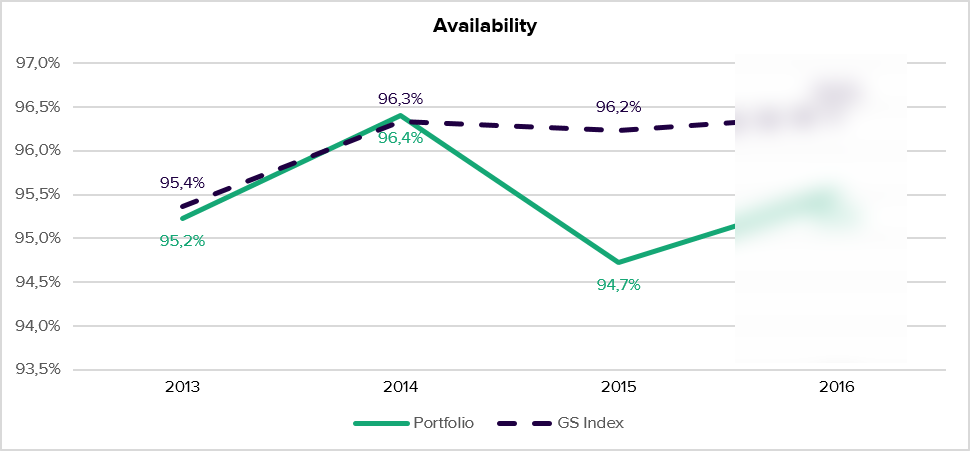

Technical Availability

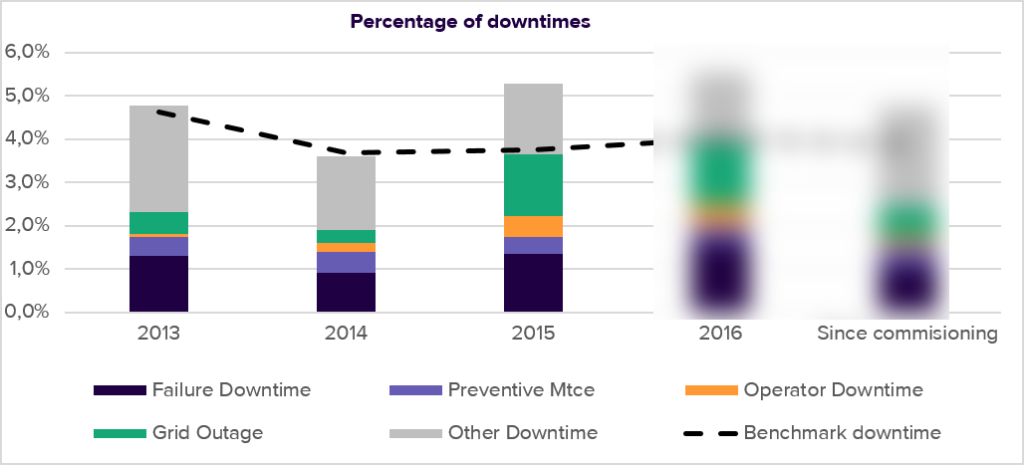

Downtimes

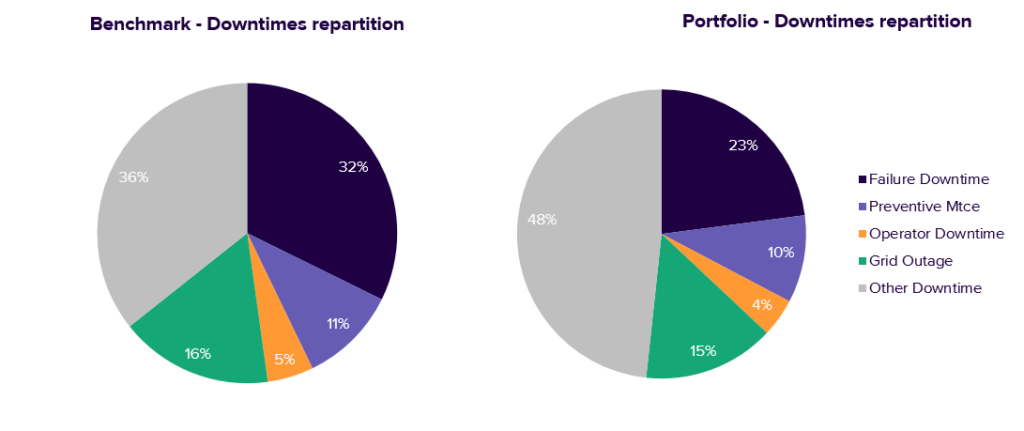

Downtime analysis by cause

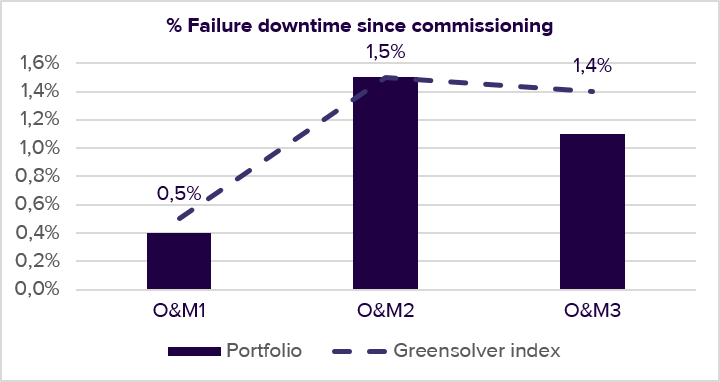

Failure & maintenance downtimes analysis by type of turbines

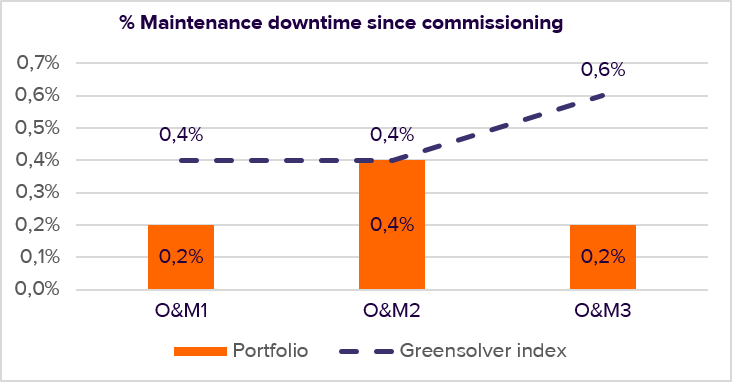

Maintenance indices

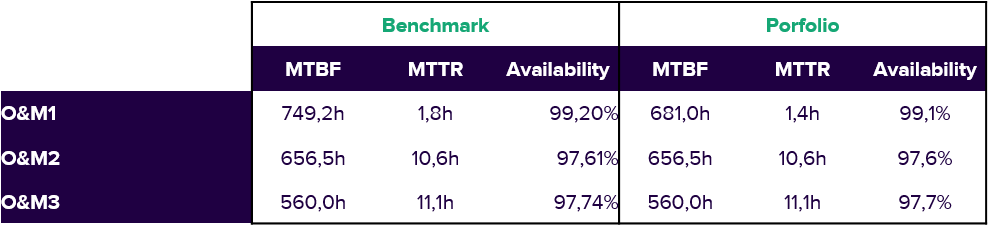

Grid outage

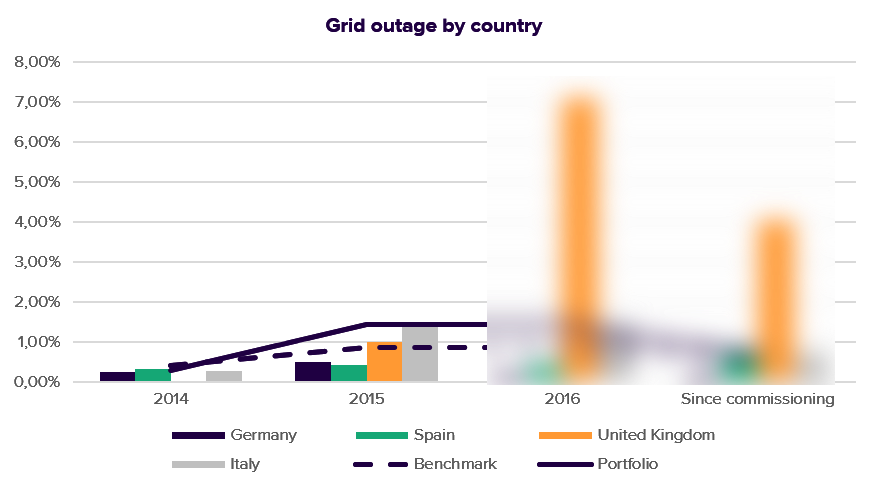

Capacity factor

Analysis

- O&M1 seems to be again best in class for this portfolio. A study could be performed comparing the difference in the wind turbine price during the investment of the wind farm and the difference in availability / performance of those wind farms to estimate if that investment is worth it or not.

- For this particular portfolio a special attention should be paid to the “Grid Outages” and the “Other Downtimes”.

- “Grid Outages” are specially high in the UK, we would here recommend to review the grid connection agreements in those problematic farms.

- For the “Other Downtimes” the problem comes mainly from Germany. This should be investigated in depth by the TM.

- More generally, the portfolio overall figures of availability and downtimes show an under-performance.