The Dutch government has published the 2016 renewable energy support’s results. As wind & solar expert, we have at heart to write thoughtful articles to deliver our expertise and identify trends on a given market. We have recently made an analysis of the auctions results and have identified some trends, which will allow investors & developers to assess the opportunities in the Dutch market and help them establish the right bidding strategy for 2017.

SDE+ subsidy – or how to spend 9 billion Euros

The first round of the 2016 budget awarded EUR 4 billion to 986 projects (representing a total of 1.546 MW). In the second round, it was EUR 5 billion awarded to 2,197 projects (representing 2.332MW). Hence, a total of 3.878MW has received SDE+ subsidy in 2016 and will need to be built in the Netherlands over the next few years.

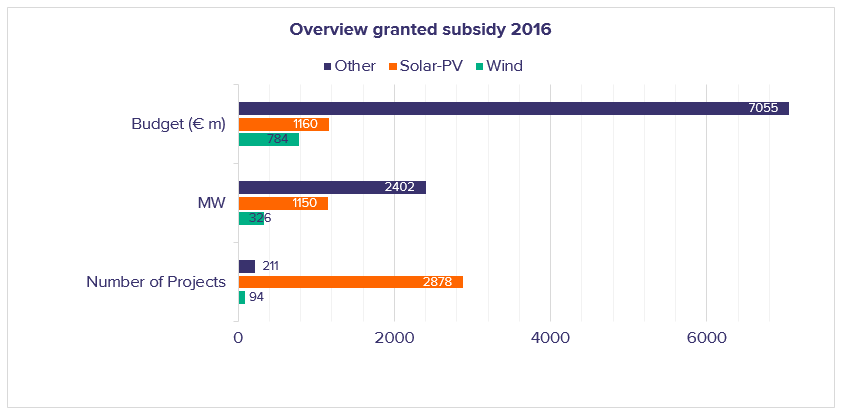

The table below shows how the subsidy has been awarded to the different technologies. A significant part of the budget has gone to the category ‘other’, dominated by co-fired biomass projects. What furthermore can be concluded is that in terms of numbers the majority of the projects that gained subsidy are solar projects. The number of wind projects that have been granted subsidy is significantly lower this year compared to solar and other technologies.

This article will make a focus on solar and onshore wind projects.

Solar – The largest winner, in numbers

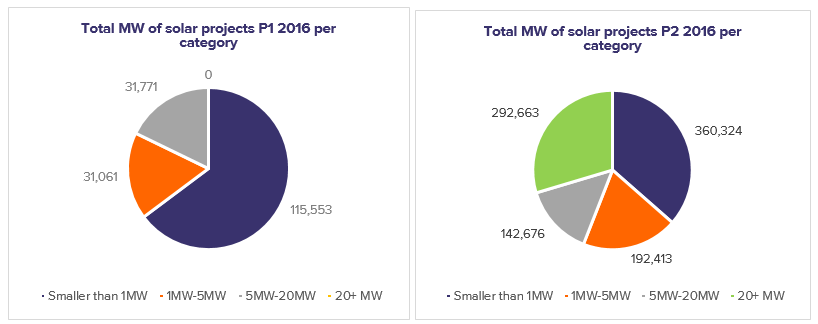

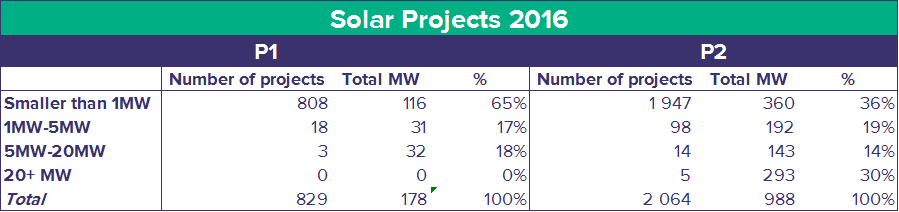

Solar projects winning subsidy clearly shift from small rooftop projects to an increasing number of large ground mounted solar projects. The table below demonstrates how the subsidy has been divided between solar projects in period I (P1) and II (P2).

Both in the first round and the second-round smaller rooftop projects have used a big piece of the budget. However perhaps one of the most interesting developments is that in round 2, 30% of the budget has been taken by projects larger than 5MWp. This category was almost not existent in the first round.

What is the reason for the solar success?

Considering that the cost per kWh for onshore wind are lower than the cost per kWh for solar in the Netherlands, wind projects should be more competitive within the SDE+ regime. Therefore, you should expect to see more onshore wind projects winning tariffs. However onshore wind projects struggle with long and tough planning procedures and without planning permission, it is impossible to bid under the SDE+.

Solar projects on the other hand, benefit from local support and shorter/ less complicated planning procedures. Furthermore, the solar business model is becoming increasingly more competitive, allowing them to successfully compete with all other renewable energy technologies.

As larger projects have greater economies of scale it is easier to secure their tariffs. Considering this and looking at the pipeline of solar projects in the Netherlands it is our expectation that the trend of larger projects getting their tariffs will continue the years to follow.

Wind project subsidy

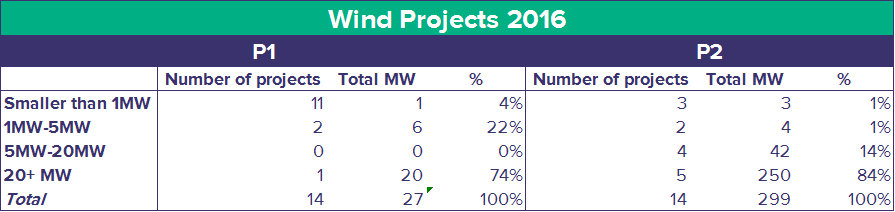

The table below shows the number of projects and their MW’s that have been able to secure tariffs in Round 1 and Round 2 of 2016.

Onshore wind: bigger but unpredictable

In total 28 onshore wind projects, have been able to secure their tariffs in 2016. The difference in MWp between round 1 and round 2 is striking, but is driven by 5 large projects. These projects took out 84% of the budget awarded to the onshore wind winners in the second round. At Greensolver, we think this is a fair reflection of where the onshore wind market is at the moment. Looking at the project pipeline we expect that smaller projects will continue to be developed by cooperatives, local initiatives, smaller developers etc. On the other hand, the larger developers and the utilities will put their efforts on building the large >100 MWp projects.

The tendency to develop larger projects will make the Dutch market more attractive for institutional investors and infrastructure funds who are looking for scale in their investments. However the tough planning procedures will make it difficult to assess when those projects will eligible to bid under the SDE+ regime

What does it tell us?

Larger projects are winning and utility scale ground mounted solar projects start to arrise. In the meantime, the number of subsidies granted to smaller (rooftop) solar projects remains high and constant.

This is not very surprising given the Dutch government willingness to push for more centralised projects instead of fragmenting turbines and small PV plants, as well as the drive towards lower costs. We also notice that the market is evolving and professionalizing. The number of applications and granted subsidies for smaller, rooftop solar projects remains high, and those are mostly developed by small developers; but we start to see the emergence of large developers making significant inroads in large scale solar and wind subsidy grants.

We expect this trend to accentuate over the coming incentive rounds. We expect to see a combination of two factors impacting the future rounds:

- Larger projects developed by large developers

- More solar projects, large and small, driven by higher social acceptance and decreasing costs

What’s next for these projects?

After the subsidy has been granted project developers have to contract a supplier (TSA/EPC) within a year. Hence, in 2017, 2.972 projects are in need of a EPC or Turbine supplier. The funding needs to be arranged and ideally the construction has to start. Wind projects need to be operational within four years after the subsidy has been granted and solar projects within 3 years. In conclusion, the Dutch market is working hard to reach the 2020 targets and is hereby creating several interesting business opportunities.

Our expectations for the first round 2017?

General

First round of 2017 has opened on March 7th, 2017 and budget for this round is another 6.0 billion. Co-fired biomass has already received the majority of its subsidy in 2016 and can only apply for approx. EUR 0.2 billion in 2017, leaving room for other technologies.

One of the questions is what the other non-wind and solar technologies (biomass/biogas/geothermal etc.) will do. Taking the average of the first and second round of 2016 we expect that these technologies will use EUR 1.9 billion of the available budget.

Onshore wind

Looking at the wind project pipelines we would expect that the trends identified in 2016 will continue in 2017. Meaning that for wind, 1 or 2 large projects (>100 MWp) will take out a big piece of the budget and a bigger number of smaller initiatives will also get their tariffs. We also would expect that 15 wind projects will successfully bid and will take EUR 1.4 billion of the budget. Considering the available budget all wind projects can simply bid at the price cap for wind under the SDE+.

This leaves approx. EUR 2.5 billion for Solar projects and the other remaining technologies, hence much more room for solar this time.

Solar

In 2016 a significant number of projects have bid, but didn’t get their tariffs. These projects will definitely bid again in first round of 2017. In addition, looking at solar development portfolios in the Netherlands, we also expect new projects to qualify and bid in 2017.

We expect to see another increase in the number of projects compared to 2016. The increase in number of projects will be largely driven by a growing number of rooftop projects, but we also expect to see more ground mounted projects. Indeed, we expect that approx. 3,000 solar projects will be able to apply and will take out EUR 2.5 billion of the budget. In the second round of 2016 the SDE+ budget ran out at 11.0 cts. This was mainly driven by a big budget using by biomass co-firing.

As mentioned before we believe that in 2017 there will be more budget available for solar and therefore projects developers might want to maximise returns by bidding at higher tariffs. Therefore, we believe we will see solar projects still winning tariffs between EUR 11.0 cts. and EUR 11.5 cts

Greensolver publishes technical articles and analysis on current market trends, delivering expert feedback and opinion to manage your wind and solar assets correctly. To receive these articles directly in your mail box, please subscribe here.