When building a financing business plan for a wind asset, investors usually have to assume – for lack of data – the guaranteed turbine availability signed with maintenance providers. This is between 95% to 97% and decreasing over time as the maintenance provider guarantee decreases. In reality, if the wind asset is properly managed and maintained, the availabilities can be much higher

The impact of this model assumption for the investor is significant. Revenue of a wind asset is directly related to availability; the higher the availability over time, the more cash flow is generated, and therefore the more debt can be raised.

Through the database of Greensolver Index that now gathers the operational data of almost 600 turbines in Europe, we are able to compute the average availability of a wind turbine throughout its lifetime, based on operator data. This is statistically reliable data, published by an independent party.

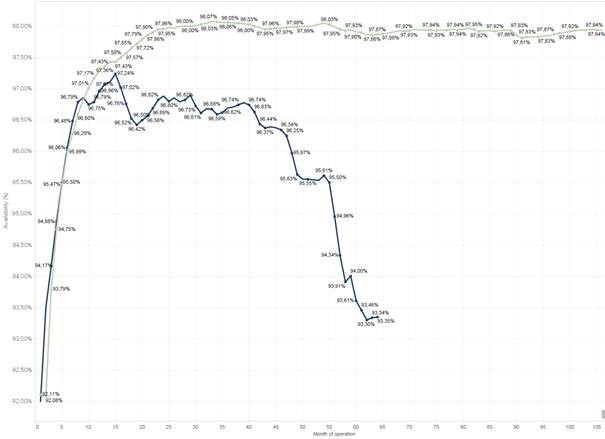

The figure above trends actual availability over the years of wind turbine operation. The green curve shows the average availability of all wind turbines since the beginning of their operation.

We observe that the availability of the wind turbines ramps up over time as teething issues are resolved. The availability reaches almost 98% after 9 years of operations.

Nevertheless, it has to be noted that the importance of strong maintenance contracts and professional asset management is critical in order to achieve such availability level. Indeed, most of the wind parks benchmarked in Greensolver Index have comprehensive availability warranties.

The blue curve shows the average availability of a wind park that has not such professional management. After the maintenance contract signed at commissioning of the asset expired, we observe that the availability of the asset quickly falls to reach 93% after 5.5 years. Lack of anticipation, lack of contractual management and lack of attention, cost dearly in this case, but can also be avoided by putting in place a proper independent, professional asset manager to run the asset.

Greensolver Index is a benchmarking tool that enables like for like comparisons of wind assets across more than 45 Key Performance Indicators. Contact us for a free demo!